Market Abuse and Insider Trading Course

In this Market Abuse and Insider Trading course, employees will learn the market abuse regulations and the simple steps organisations and individuals can take to make sure they comply with them.

Suitable for All Levels

Online Assessment

Course aims

By the end of this course, you will be able to:

- Ensure organisational compliance with the Market Abuse Regulations

- Ensure personal compliance with the Market Abuse Regulations

- Improve general compliance within your organisation

- Help to develop a compliance culture within your organisation

- Help your company avoid potentially costly litigation and fines

Requirements

None

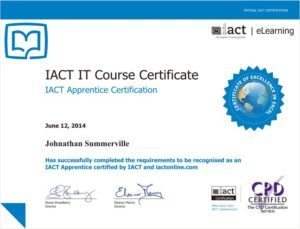

Certification

At the end of the course, you’ll be Certified by the Irish Academy of Computer Training

Who would benefit

This course will benefit all those who need a comprehensive understanding of the criminal and civil market abuse and insider dealing regime and how it impacts the financial services industry. The course will help those attending to understand the expectations of the regulator and assist them to manage the market abuse risk within their business.

Why take the Course

If employees share inside information, or use it to buy or sell shares, they are likely to be breaching Insider Trading rules and could face severe reputational, legal, and professional consequences. That is why employees need rigorous and thorough compliance training on Insider Trading.

Insider Trading is aggressively investigated and prosecuted. It is heavily regulated, monitored, and punished. It is one of the most aggressively investigated and prosecuted areas of trading law.

Course curriculum

What will be covered throughout this course?

- What is Insider Trading and Market Abuse

- The regulations and the law

- Historical Context

- The Legislation

- The Approach of the Regulator

- Consequences of Insider Trading and Market Abuse

- Material non-public information

- Designations, restrictions and trading windows

- Insider Dealing & Unlawful Disclosure of Inside Information

- Safe Harbours

- Legitimate Behaviour

- Market Soundings – Requirements

- Market Manipulation

- Safe harbours

- Other Requirements / Preventative Measures:

- Public Disclosure of Inside Information and Ability to Delay

- Insider Lists – New Requirements and Harmonisation of Content

- Suspicious Transactions and Orders Reports (STORS)

- Restrictions and Notifications

Similar courses

Contact us.

One of our team will give you any details you need in person, by phone or by e-Mail. Whichever suits you.

Enquiry

"*" indicates required fields

I understand that my personal data is being processed in accordance with the privacy notice and accept the terms and conditions of use.